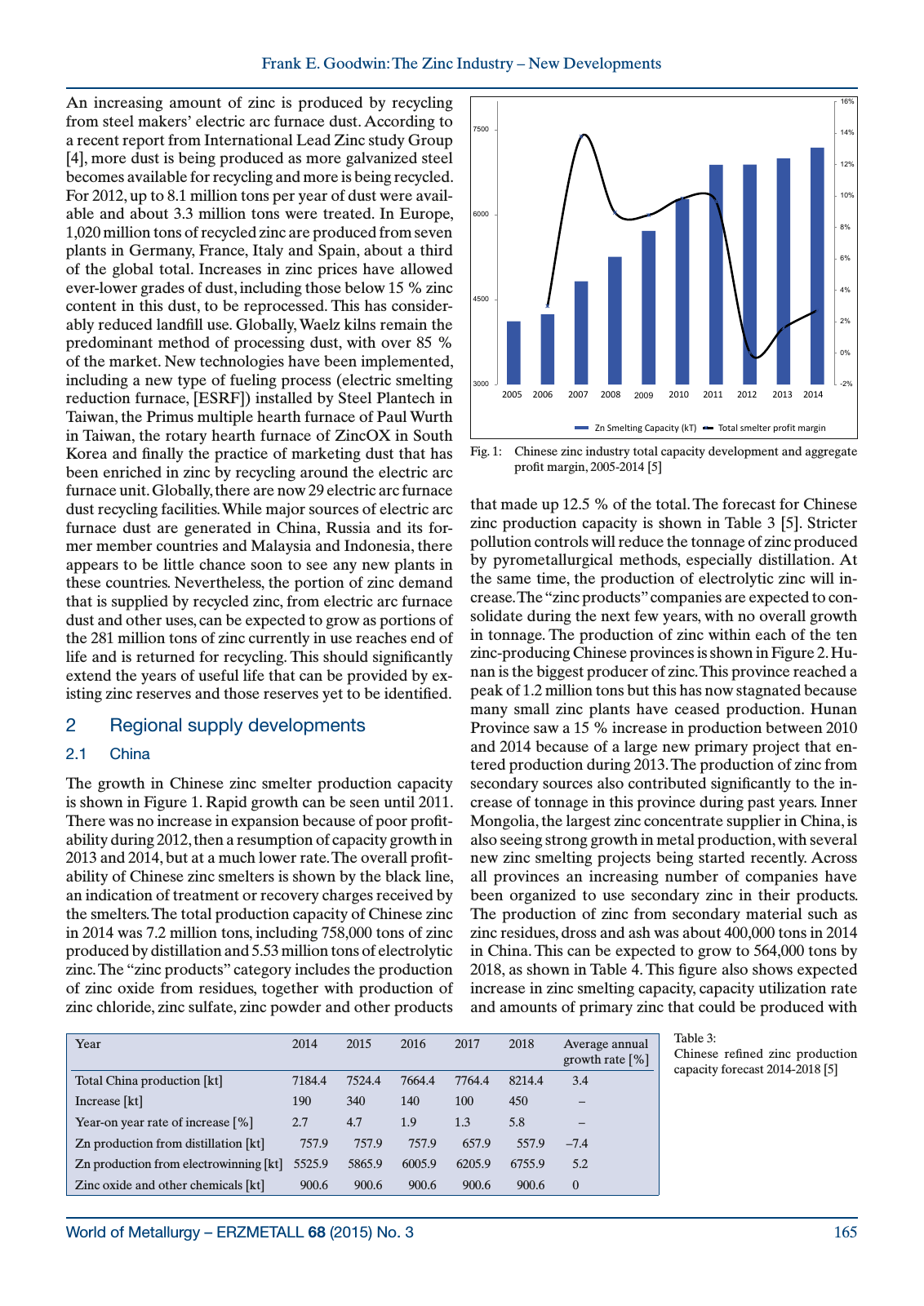

World of Metallurgy ERZMETALL 68 2015 No 3 165 Frank E Goodwin The Zinc Industry New Developments An increasing amount of zinc is produced by recycling from steel makers electric arc furnace dust According to a recent report from International Lead Zinc study Group 4 more dust is being produced as more galvanized steel becomes available for recycling and more is being recycled For 2012 up to 8 1 million tons per year of dust were avail able and about 3 3 million tons were treated In Europe 1 020 million tons of recycled zinc are produced from seven plants in Germany France Italy and Spain about a third of the global total Increases in zinc prices have allowed ever lower grades of dust including those below 15 zinc content in this dust to be reprocessed This has consider ably reduced landfill use Globally Waelz kilns remain the predominant method of processing dust with over 85 of the market New technologies have been implemented including a new type of fueling process electric smelting reduction furnace ESRF installed by Steel Plantech in Taiwan the Primus multiple hearth furnace of Paul Wurth in Taiwan the rotary hearth furnace of ZincOX in South Korea and finally the practice of marketing dust that has been enriched in zinc by recycling around the electric arc furnace unit Globally there are now 29 electric arc furnace dust recycling facilities While major sources of electric arc furnace dust are generated in China Russia and its for mer member countries and Malaysia and Indonesia there appears to be little chance soon to see any new plants in these countries Nevertheless the portion of zinc demand that is supplied by recycled zinc from electric arc furnace dust and other uses can be expected to grow as portions of the 281 million tons of zinc currently in use reaches end of life and is returned for recycling This should significantly extend the years of useful life that can be provided by ex isting zinc reserves and those reserves yet to be identified 2 Regional supply developments 2 1 China The growth in Chinese zinc smelter production capacity is shown in Figure 1 Rapid growth can be seen until 2011 There was no increase in expansion because of poor profit ability during 2012 then a resumption of capacity growth in 2013 and 2014 but at a much lower rate The overall profit ability of Chinese zinc smelters is shown by the black line an indication of treatment or recovery charges received by the smelters The total production capacity of Chinese zinc in 2014 was 7 2 million tons including 758 000 tons of zinc produced by distillation and 5 53 million tons of electrolytic zinc The zinc products category includes the production of zinc oxide from residues together with production of zinc chloride zinc sulfate zinc powder and other products that made up 12 5 of the total The forecast for Chinese zinc production capacity is shown in Table 3 5 Stricter pollution controls will reduce the tonnage of zinc produced by pyrometallurgical methods especially distillation At the same time the production of electrolytic zinc will in crease The zinc products companies are expected to con solidate during the next few years with no overall growth in tonnage The production of zinc within each of the ten zinc producing Chinese provinces is shown in Figure 2 Hu nan is the biggest producer of zinc This province reached a peak of 1 2 million tons but this has now stagnated because many small zinc plants have ceased production Hunan Province saw a 15 increase in production between 2010 and 2014 because of a large new primary project that en tered production during 2013 The production of zinc from secondary sources also contributed significantly to the in crease of tonnage in this province during past years Inner Mongolia the largest zinc concentrate supplier in China is also seeing strong growth in metal production with several new zinc smelting projects being started recently Across all provinces an increasing number of companies have been organized to use secondary zinc in their products The production of zinc from secondary material such as zinc residues dross and ash was about 400 000 tons in 2014 in China This can be expected to grow to 564 000 tons by 2018 as shown in Table 4 This figure also shows expected increase in zinc smelting capacity capacity utilization rate and amounts of primary zinc that could be produced with Table 3 Chinese refined zinc production capacity forecast 2014 2018 5 Year 2014 2015 2016 2017 2018 Average annual growth rate Total China production kt 7184 4 7524 4 7664 4 7764 4 8214 4 3 4 Increase kt 190 340 140 100 450 Year on year rate of increase 2 7 4 7 1 9 1 3 5 8 Zn production from distillation kt 757 9 757 9 757 9 657 9 557 9 7 4 Zn production from electrowinning kt 5525 9 5865 9 6005 9 6205 9 6755 9 5 2 Zinc oxide and other chemicals kt 900 6 900 6 900 6 900 6 900 6 0 3000 4500 6000 7500 2 0 2 4 6 8 10 12 14 16 冶炼产能 kt 利润同比 2009 Zn Smelting Capacity kT Total smelter profit margin 2005 2006 2007 2008 2010 2011 2012 2013 2014 Fig 1 Chinese zinc industry total capacity development and aggregate profit margin 2005 2014 5

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.