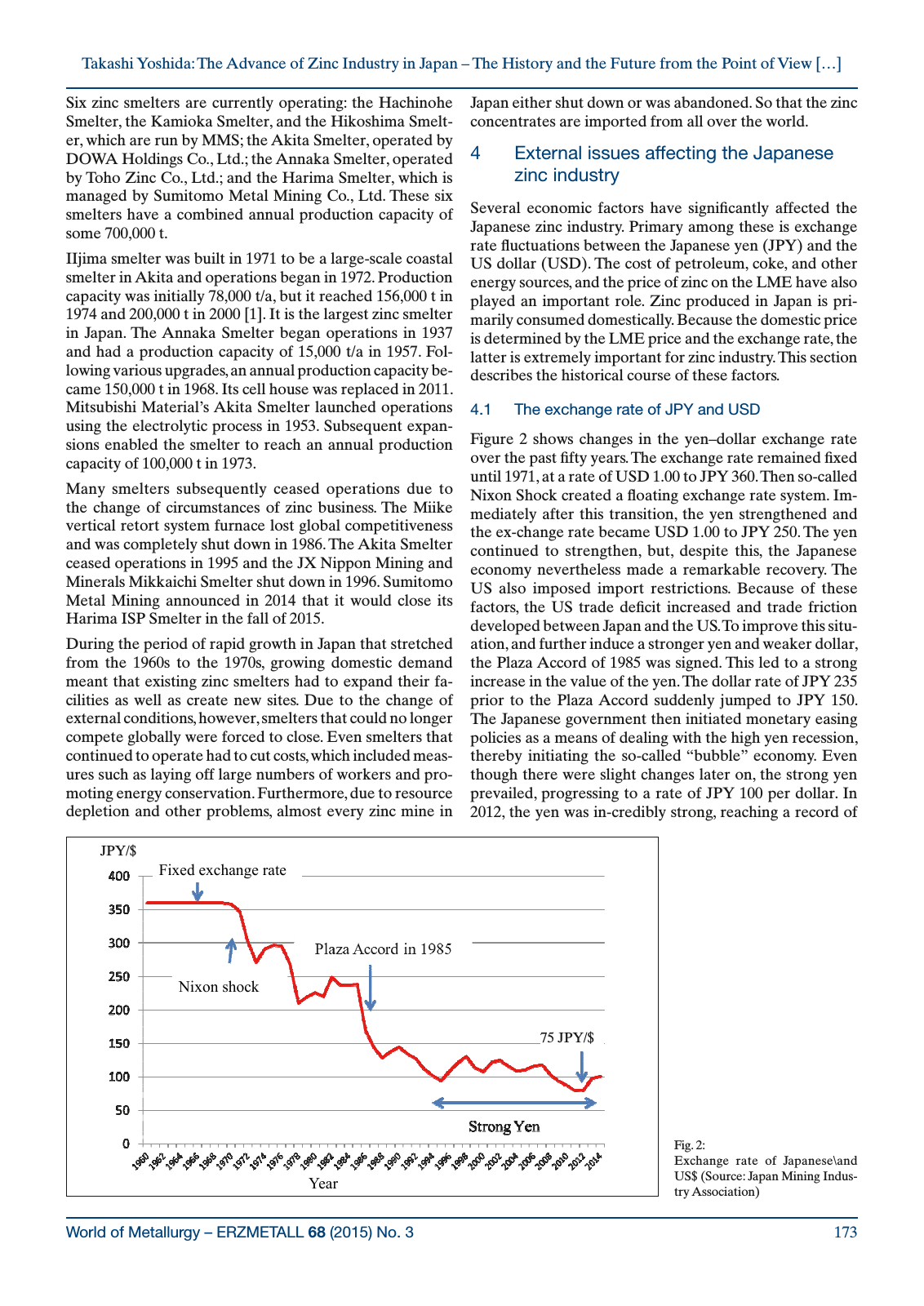

World of Metallurgy ERZMETALL 68 2015 No 3 173 Takashi Yoshida The Advance of Zinc Industry in Japan The History and the Future from the Point of View Six zinc smelters are currently operating the Hachinohe Smelter the Kamioka Smelter and the Hikoshima Smelt er which are run by MMS the Akita Smelter operated by DOWA Holdings Co Ltd the Annaka Smelter operated by Toho Zinc Co Ltd and the Harima Smelter which is managed by Sumitomo Metal Mining Co Ltd These six smelters have a combined annual production capacity of some 700 000 t IIjima smelter was built in 1971 to be a large scale coastal smelter in Akita and operations began in 1972 Production capacity was initially 78 000 t a but it reached 156 000 t in 1974 and 200 000 t in 2000 1 It is the largest zinc smelter in Japan The Annaka Smelter began operations in 1937 and had a production capacity of 15 000 t a in 1957 Fol lowing various upgrades an annual production capacity be came 150 000 t in 1968 Its cell house was replaced in 2011 Mitsubishi Material s Akita Smelter launched operations using the electrolytic process in 1953 Subsequent expan sions enabled the smelter to reach an annual production capacity of 100 000 t in 1973 Many smelters subsequently ceased operations due to the change of circumstances of zinc business The Miike vertical retort system furnace lost global competitiveness and was completely shut down in 1986 The Akita Smelter ceased operations in 1995 and the JX Nippon Mining and Minerals Mikkaichi Smelter shut down in 1996 Sumitomo Metal Mining announced in 2014 that it would close its Harima ISP Smelter in the fall of 2015 During the period of rapid growth in Japan that stretched from the 1960s to the 1970s growing domestic demand meant that existing zinc smelters had to expand their fa cilities as well as create new sites Due to the change of external conditions however smelters that could no longer compete globally were forced to close Even smelters that continued to operate had to cut costs which included meas ures such as laying off large numbers of workers and pro moting energy conservation Furthermore due to resource depletion and other problems almost every zinc mine in Japan either shut down or was abandoned So that the zinc concentrates are imported from all over the world 4 External issues affecting the Japanese zinc industry Several economic factors have significantly affected the Japanese zinc industry Primary among these is exchange rate fluctuations between the Japanese yen JPY and the US dollar USD The cost of petroleum coke and other energy sources and the price of zinc on the LME have also played an important role Zinc produced in Japan is pri marily consumed domestically Because the domestic price is determined by the LME price and the exchange rate the latter is extremely important for zinc industry This section describes the historical course of these factors 4 1 The exchange rate of JPY and USD Figure 2 shows changes in the yen dollar exchange rate over the past fifty years The exchange rate remained fixed until 1971 at a rate of USD 1 00 to JPY 360 Then so called Nixon Shock created a floating exchange rate system Im mediately after this transition the yen strengthened and the ex change rate became USD 1 00 to JPY 250 The yen continued to strengthen but despite this the Japanese economy nevertheless made a remarkable recovery The US also imposed import restrictions Because of these factors the US trade deficit increased and trade friction developed between Japan and the US To improve this situ ation and further induce a stronger yen and weaker dollar the Plaza Accord of 1985 was signed This led to a strong increase in the value of the yen The dollar rate of JPY 235 prior to the Plaza Accord suddenly jumped to JPY 150 The Japanese government then initiated monetary easing policies as a means of dealing with the high yen recession thereby initiating the so called bubble economy Even though there were slight changes later on the strong yen prevailed progressing to a rate of JPY 100 per dollar In 2012 the yen was in credibly strong reaching a record of Fig 2 Exchange rate of Japanese and US Source Japan Mining Indus try Association Fixed exchange rate Nixon shock 75 Year 75 JPY JPY

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.